Low Expectations (Again) for Google Earnings July 16th, 2015

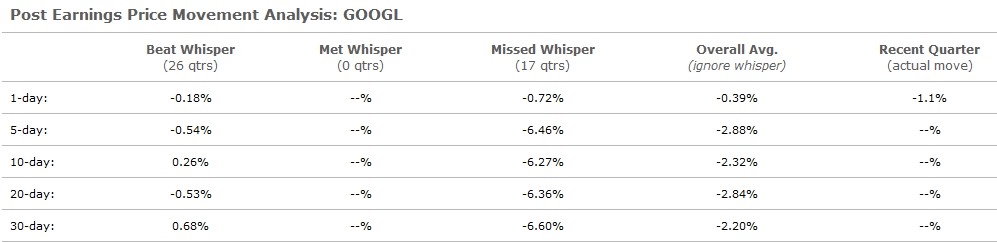

Earnings history: - Beat whisper: 26 qtrs - Met whisper: 0 qtrs - Missed whisper: 17 qtrs The 'low' whisper number expectation should not come as a surprise. Investors had come to expect blow out numbers quarter in and quarter, and when that stopped so did the excitement that came with a Google earnings report. Over the past six quarters, Google has reported earnings short of the whisper number expectation in five reports. Another factor - Google's stock price is trading at the same levels as one year ago. Investor's and traders want earnings growth, and right now Google is not delivering. Our primary focus is on post earnings price movement. Knowing how likely a stock's price will move following an earnings report can help you determine the best action to take (long or short). In other words, we analyze what happens when the company beats or misses the whisper number expectation. The table below indicates the average post earnings price movement within a one and thirty trading day timeframe:

The strongest price movement of +0.7% comes within thirty trading days when the company reports earnings that beat the whisper number, and -6.6% within thirty trading days when the company reports earnings that miss the whisper number. Although the strongest price moves are as expected, the overall average post earnings price move is very limited and 'negative' (beat the whisper number and see weakness, miss and see weakness) when the company reports earnings. The table below indicates the most recent earnings reports and short-term price reaction:

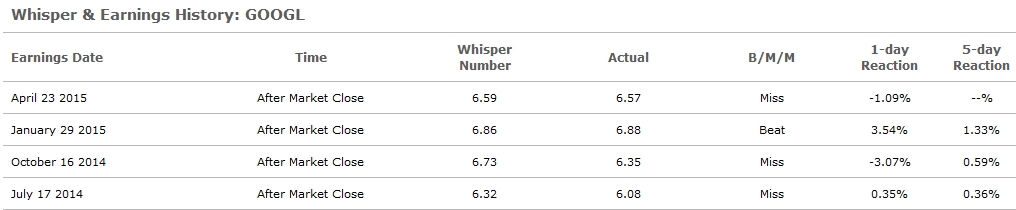

The company has reported earnings ahead of the whisper number in one of the past four quarters with a whisper number. In the comparable quarter last year the company reported earnings twenty-four cents short of the whisper number. Following that report the stock realized a 0.4% gain in five trading days. Last quarter the company reported earnings two cents short of the whisper number. Following that report the stock realized a 3.1% loss in one trading day, before turning and seeing a 1.1% loss within one trading day. Overall historical data indicates the company to be (on average) a 'negative' price reactor when the company reports earnings. Enter your expectation and view more earnings information here. Since 1998, WhisperNumber.com has been tracking and publishing crowd-sourced estimates for earnings. We call these earnings expectations whisper numbers. Our whisper numbers are gained from individual investors and traders just like you that have registered with our site. WhisperNumber is completely open and free for anyone to contribute. While the whisper number itself is an important part of our analysis, a company's 'price reaction' to beating or missing the whisper number expectation is the key. On average, companies that exceed the whisper are 'rewarded', while companies that miss are 'punished' following an earnings report. Trading on whispers is a technical play on market psychology, rather than a bet on a company's fundamental strengths. |

||||||||||||||||||

| ||||||||||||||||||